London Home Show Sponsors: Meet Tembo

What help is there for first time buyers in 2025?

Owning your first home can feel like an overwhelming dream. With the average first time buyer needing to save 50% of their monthly income for nearly a decade to save for a deposit, and house prices increasing 104% in the last 50 years (even when adjusting for inflation), it’s easy to feel like homeownership is completely out of reach.

But the good news? There’s more innovation than ever, with numerous schemes and solutions designed to make buying more accessible and affordable for those looking to take their first step onto the ladder.

Let’s go over some of the best options for first time buyers.

First time buyer schemes

Lifetime ISA: Boost your deposit savings

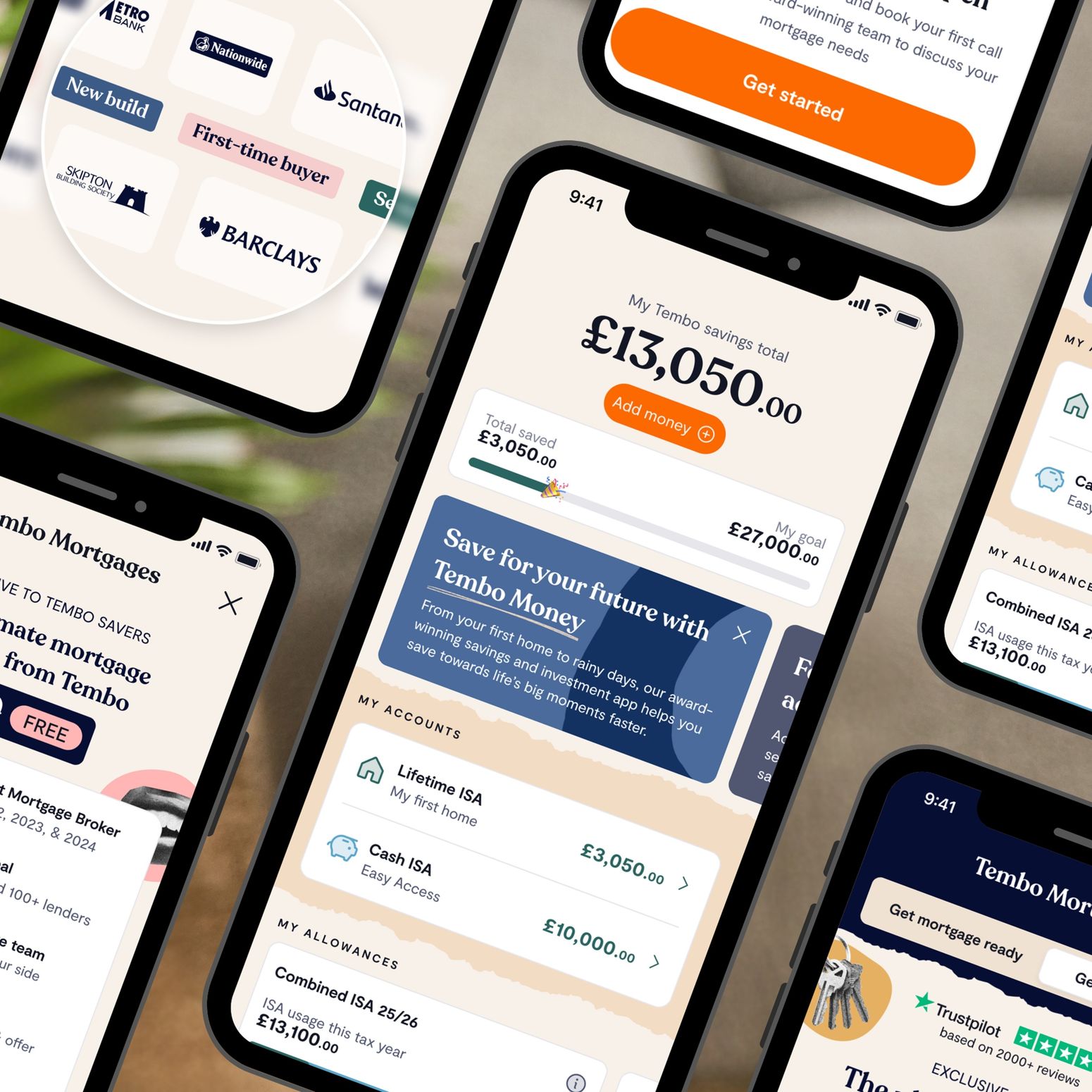

Saving for a deposit is one of the biggest obstacles for first time buyers, but a Lifetime ISA (LISA) can give your efforts a major boost. With a LISA, you can save up to £4,000 tax-free every tax year, and the government will boost your savings by 25%, giving you up to £1,000 free each tax year. This means if you maxed out your LISA every year for five years, you’d get a £5,000 bonus from the government – bringing your total deposit to £25,000!

Maximise your savings with the Tembo Cash LISA and you’ll earn hundreds more compared to the next best provider on the market*.

Ineligible withdrawals may return less than paid in. You must be 18 to 39 years old to open a Lifetime ISA. Tax treatment depends on individual circumstances and may be subject to change in the future. A Lifetime ISA must be open for at least 12 months before being used to buy a first home worth £450,000 or less.

Savings as Security: Help from family

Got loved ones who want to help but can’t offer cash upfront? With a Savings as Security mortgage, a family member’s savings can act as a guarantee – allowing you to secure a home without needing your own deposit. They deposit usually 10% of the property’s value in a special savings account held by the lender. After five years, provided mortgage repayments are on track, their savings are returned with any interest accrued.

Deposit Boost: Unlock the value in family homes

If your family owns property, a Deposit Boost enables them to tap into their home’s equity to release money that can be used to contribute to your house deposit. This approach not only increases your buying budget but can also help you secure better interest rates by putting down a larger deposit, lowering your monthly repayments.

Higher lending: Increase your borrowing power

A loved one can also help you borrow more through an Income Boost, in which they add all or some of their income to your mortgage application. By doing so your relative acts as a guarantor for your mortgage payments without owning a share of your property – it’s completely under your name. With their income added to yours, you’ll be able to boost your borrowing potential.

If you don’t have a guarantor for an Income Boost mortgage, you might be eligible for a 5.5x Income Mortgage or Professional Mortgage. These allow you to borrow more than a standard mortgage based on your profession or household income.

Low or no-deposit mortgage options

For those without a hefty deposit saved or family who can help, there are other pathways to homeownership.

- Low-deposit mortgages like the government’s Mortgage Guarantee scheme allow you to purchase with as little as 5% saved.

- No-deposit mortgages like Skipton’s Track Record Mortgage enable you to use your rental payment history as proof that you can afford mortgage repayments.

Shared Ownership

If buying outright feels out of reach, Shared Ownership lets you purchase a share of a property (often between 10% and 75%) while paying rent on the remaining share. Over time, you can buy additional shares, staircasing your way to full ownership.

Take the first step

Getting your foot on the ladder might feel daunting, but with the right tools and team behind you, it’s achievable. Complete Tembo’s free mortgage fact-find today to discover all the ways you can get on the ladder. It’s free, takes just 10 minutes and there’s no credit check involved. Our smart tech will compare your eligibility to thousands of mortgages and innovative schemes, showing you all the ways you could buy. Get started here.

Your home may be repossessed if you do not keep up repayments on your mortgage.

*Rates are accurate as of 11th August 2025. Calculations show at month 61 (after five years) Tembo customers saving at 4.10% would have £377.11 more than with the closest market competitor.

Attend the London Home Show

Tickets for the London Home Show are free, but visitors must register in advance to attend. For more information, or to reserve your place at the capital’s no.1 first time buyer event, please visit the event page.

Share to Buy lists thousands of affordable properties across the country, including those available through Shared Ownership, Rent to Buy, and Discount Market Sale. Learn more about the different buying and rental schemes available today.